The day after AMD announced their quarterly results, Intel followed up with a very impressive quarter of their own. Intel has reported another record quarter with $17B in revenue and $5B net. The business is extremely healthy and they continue to provide a lot of value and returns to shareholders. Typically Q2 is the second slowest quarter of the year, but Intel was able to improve their revenues by $900M over Q1. In certain quarters a 5% increase may not be all that large, but it is a significant jump from Q1 to Q2.

Intel reported that nearly all areas of the company have grown. Client Computing Group showed a 6% increase year over year, which is good news for the industry in general as many have (often) predicted that the PC market is in decline. This is also in the face of renewed competition from AMD and their Zen architecture based products. AMD also has grown steadily over the past year in terms of shipping products, so that further reinforces the impression that the PC market continues to grow steadily.

The data-centric business is steadily closing the gap between it and the PC centric group. CCG posted $8.7B in revenues while the data groups combined came in at around $8.1B. The Data Center Group was $5.5B of that result. It is up a very impressive 27% yoy. Intel has what seems to be a juggernaut in the data center with their Xeon products, and that growth is quite likely to continue growing as the need for data processing in our information rich world seemingly knows no bounds.

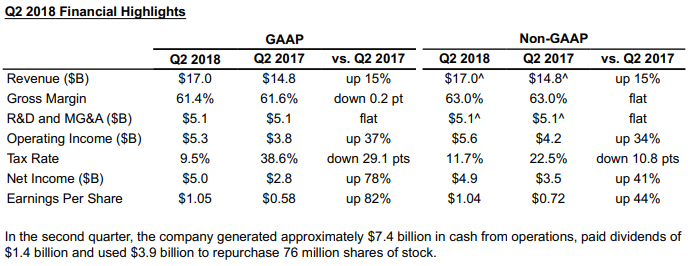

Intel raised their outlook for the year by nearly $2B to an impressive $69B in revenues. This is easily 10x that of their primary competitor. 2018 has certainly been a very profitable year for Intel and it looks to continue that trend throughout the last two quarters. Intel continues to improve upon their 14nm processes and it has allowed them to achieve a 61.4% margin. Compare this to AMD’s 37% margin and we can understand why 2018 is looking so good. Intel has lost a little bit on margin as compared to last year, but the amount of products being shipped is simply stunning as compared to its rival.

There were some expecting AMD to be taking up more of Intel’s marketshare, but that has not been the case. If anything, while AMD’s bottom line has improved, Intel appears to have actually taken more share in an expanding market. Unlike 2003 when AMD had the superior product with the Athlon 64 over Intel’s Pentium 4, the current Ryzen CPUs are “merely” competitive. While the performance and efficiency jump for AMD’s architecture is impressive considering the previous “Bulldozer” based generation, they now offer comparable performance with a price/core count advantage over Intel. This has not been enough to convince people and organizations to change en masse to AMD’s offerings. In 2003 a 2 GHz Athlon 64 was outperforming a 3.2 GHz Pentium 4. AMD was able to continue outperforming Intel even though they were at a serious process disadvantage.

While Q3 and Q4 look to continue Intel’s string of record quarters, things do not look as rosy when we get into 2019. Intel has had an endless stream of problems getting their advanced 10nm process up and running. It was originally expected to replace Intel’s 14nm process around two years after that particular process had been introduced. Then it turned into three years. Now we are five years into Intel using a 14nm variant for their latest generation of products. Intel used to have a 18 to 24 month lead over the competition when it comes to process technology, but now that advantage has all but evaporated. In theory Intel’s 10nm process is superior to what TSMC is offering with its 7nm in terms of die size, power, and transistor performance. However, those advantages do not amount to anything if it is unworkable. Intel has been very tight lipped with analysts and shareholders about the exact issues it is facing with the direction they set on with 10nm. It seems the combination of materials, tolerances, and self-aligned quad patterning is problematic enough that Intel cannot get consistent results with yields and bins.

In the conference call Intel said that 10nm parts will be available on shelves by the holiday season of 2019. This means that Intel expects to hit high volume manufacturing near the end of 1H 2019. Intel further stated that data center parts will be shipping shortly after desktop and mobile, so most expect the first products to hit in Q1 2020. The problem that Intel will is that TSMC will be starting volume manufacturing of their 7nm parts shortly, if not already. AMD has 7nm EPYC sampling to partners and has spoken of a 1H introduction of those parts in volume. AMD will be introducing the Zen 2 architecture in that time on both server and desktop, and they are hinting at a significant IPC uplift with these parts.

If Intel is able to hit its 10nm goal in late 2019, AMD will have around a nine month window where they theoretically could have a superior product than Intel. AMD will surely come ahead from a density standpoint. If we combine this with the potential IPC improvement and a small uplift in transistor performance, then Zen 2 products should be able to outclass anything Intel comes out with. If AMD is really on the ball, then their EPYC processors could have a year to themselves without a comparable product from Intel.

This type of competition does not mean that Intel will simply shrivel up and die, but it is causing investors to rethink holding onto the stock after the pretty impressive run up over the past several years. Intel still has more fab space available to it than AMD could dream of at this point. There will be a lot of competition for 7nm wafer starts that will be shared by AMD, NVIDIA, Qualcomm, and Apple (not to mention dozens of other fab-less semi firms). AMD could very well sell as many chips as it can make, but it simply cannot address the needs of all of the markets that it is competing in. If GLOBALFOUNDRIES 7nm process is similar to TSMC’s, then we will see AMD be able to supply far greater amounts of product to the market, but GF is at least six months behind TSMC when it comes to ramping up their next generation process line. I would not expect GF based CPUs to hit anytime before Q2 2019, if not towards the end of that quarter.

Does this mean that Intel expects nothing except doom and gloom throughout 2019 and possibly into 2020? I do not think so. Intel will retain its market dominance, but it looks to be experiencing a situation that is a combination of a competitor hitting its stride as well as some bad luck/poor planning with manufacturing. This should open the door for AMD to make significant advances in marketshare and allow the company to make some serious money by improving their ASPs as well as shipping more parts.

2018 will undoubtedly be a record year for Intel. It is 2019 that is giving pause to investors and shareholders. If Intel can clean up its 10nm process in a timely manner they will close the door on any advances from AMD. If the company continues to experience issues with 10nm and never in fact gets it out the door, then it will be a long couple of years til Intel gets out their 7nm process. The rumor is that engineers have been pulled off of 7nm to fix 10nm. If this is the case, then I hesitate to even think when we will be seeing that upcoming node coming to fruition.

I continue to be surprised by

I continue to be surprised by Intels insistence on getting 10nm up and running. At what point does it make sense to just jump ahead towards 7nm, unless both are hitting roadblocks. Shouldn’t 7nm have been close to replacing 10nm shortly according to the original timelines?

The delays in 10nm have not been costing Intel anything up until this point as nothing in the market was competitive with the oh r offerings. Now it is going to be different as AMD catches up and the delays and security issues are giving them a black eye.

EVERY chip manufacturer plays

EVERY chip manufacturer plays pretty fast and loose when it comes to the nomenclature of their particular “process node”. Accuracy and consistency don’t apply here, just marketing. Don’t fall for their game.

As usual PCPer’s response is

As usual PCPer’s response is so Intel sided, even when they mention something good of AMD, it is followed by a “but.”

I really have hoped for PCPer to become more unbiased, but you still have business interests with them, so it is understandable (although unethical) that you would not have them look bad.

Well, let me ask you a few

Well, let me ask you a few questions…

Did Intel have a bad quarter? Does it look like Intel is going to have a bad year? Ryzen is competitive and has lead AMD to have some historically good quarters, but not great quarters. Why has it shaken out that way? Even with 10nm issues, most analysts still see 2019 as a $70B year for the Intel, and they should end 2018 at $69.5B. So even with the uncertainty of 10nm, why is Intel still valued so highly and expected to have another strong year?

I want to see AMD thrive in the years to come and have meaningful competition for Intel. The results from the past year have shown Ryzen to be successful, but not nearly at the levels that Athlon 64 was after its release. It is a very different market in 2003/2004 than this past year. If 10nm is even more delayed and Intel's response is slow coming, then AMD should have a banner year in 2019.

I'm not entirely sure how analyzing pretty black and white numbers for 2018 so far has made me biased towards Intel. The financial results from the past year give a pretty accurate accounting to how both companies have fared.

Intel’s got margins to look

Intel’s got margins to look out for and a high business overhead operating its own fabs and other expenses that AMD does not have. AMD’s turning profits on just 33-37 percent gross margins and Intel has big revenues and big operating expenses that will require maintaining those 60% gross margins. AMD being fabless has none of those worries about the billions necessary to maintain expensive chip fabs and it’s the third party fabs that are responsible for keeping their fabs operating at full capacity. AMD’s got TSMC and GlobalFoundries and can even use Samsung if necessary with that modified contract with GF that allows AMD to have more fab capacity options. GF has stated that they alone can not supply AMD with enough leading edge fab capacity.

Those first generation Zen/Zeppelin dies will remain in production for a good long while as for Epyc and servers there is that 5 years of guaranteed CPU SKU availbility that the server/HPC/Cloud markets demand. AMD’s Ryzen Pro SKUs will also have that extended product availability so GF will still be turing out some 14nm production while it transistions to 7nm along with TSMC. GF is doing a good business on its FDSOI line of fab services and togather with TSMC/Samsung that’s plenty of fab capacity for AMD’s future needs.

Intel just lost a billion dollar fab customer as a result of that 10nm delay and Intel’s got some very large fab expenses that will bring down any earnings if AMD’s server market share begins to get larger faster than expected. AMD’s first generation Epyc has passed the vetting/certification process with flying colors and has now begun its first few quarters of production usage. Intel will have to begin to lower its markups/margins in its cash cow server/HPC market Xeon lines jsut to compete of the price/performance metrics with AMD’s Epyc abd there are some things like PCIe lanes amd memory channels offered on 1P and 2P server MBs that Intel still can not match and 1P and 2P servers make up a good majority of the server market so that’s to AMD’s advantage.

If Intel beins showing any unusual gross margin declines then Wallstreet will devinitely take notice, and Intel’s 10nm fab process node delays will put them even fruther behind in getting to 7nm-5nm while AMD is already beginning to sample 7nm parts in sdvance of full production in 2019.

Record revenue numbers can be shown by just keeping up with inflation if those profit figures are not looked at more closely and Intel is a very large company so those revenue streams are going to be larger. Stock buy backs can also modify any per share figures so that has to be factored out of any company’s quarterly figures.

The Wallstreet quants are measuring the fundamentals of Intel’s performance in the face of renewed competition from AMD’s Epyc competition and that’s measuring by the quants includes many different model scenarios. And the quants will run many scenarios and look at the consensus and maby that’s why Intel’s share value too a hit. You can Google Intel’s Gross Margin history charts and just about Pinpoint on those charts where and when AMD’s Opteron server competition had its high water mark relative to Intel’s lowerst gross margin figures on that gross margin history chart.

It certainly does cost a lot

It certainly does cost a lot to own a fab, but so far Intel has made it work for them. Achieving 61% margins while running those monstrosities is still impressive. But I think that a company the size of Intel with that income is better off running their own for at least the next 5 to 10 years. Yes, the cost of keeping one will continue to rise at a pretty drastic rate as the technology advances. For now Intel has more direct control over their product stack and that has been good for them. Consider that being fabless, AMD had a strong quarter but their profits were only $116M from $1.76B in revenue (6.5%). Now compare that to Intel's $5B net from $17B revenue (29.4%).

So while some of what you state about Fabs is certainly correct, I think that Intel's position is such that your analysis on how it affects the company is off. Currently it is not an anchor weighing them down, but it certainly could be if they do not get their manufacturing in order for 2019.

Keeping those margins above

Keeping those margins above 55% for Intel is vital or Intel is going to have to cut its costs in a painful manner. AMD’s Epyc sales biggest hit on Intel will be in the area of higher margins and that’s going to force Xeon markups downward in order for Intel to keep Epyc from getting rapidly back towards the market share that AMD has at the height of its around 23% server market share Opteron days. AMD’s Zen/Zeppelin dies/wafer yields are so high, above 80%, that first generation Epyc’s pricing latitude compared to Intel’s Xeon can not be easily matched. And Intel’s margins were most affected the last time by AMD’s Opteron competition.

Looking at the old Intel Gross Margin History charts and what Opteron was able to do to Intel’s gross margins and that should have any Intel investors worried. Epyc is orders more closer to Xeon than Opteron was in raw performance, and that’s not even considering the Memory channel and PCIe lanes advantage that AMD currently offers with first generation Epyc platform 1P and 2P motherboards.

Epyc looks set to take even more market share faster because of all the pluses the frist generation Epyc platform offers. Those Zen/Zeppelin wafers have been in full production at 80%+ die/wafer yields for a good while and the tweaks/steppings and available quality of the bins is going up. I’d say that the first 10% of Epic’s server market share will be on First generation Epyc sales alone and maybe 10% is being too conservative owing to the interest in AMD’s Epyc from the server/HPC/AI markets.

Achieving 61% margins in the absence of any meaningful competition is not hard and Intel has had even higher gross margin figures than 61%. But Looking at the Epyc benchmarks and the Feature advantage that the Epyc Platform has relative to the 1P and 2P Xeon/MB offerings tells me that Intel is in for some lower margins over the upcoming quarters as Intel can not piviot fast enough to stop Epyc from taking more server market share even before Epyc/Rome sales begin to add to the gains in 2H 2019.

Once Epyc/Rome supplants Epyc/Naples for top spot on AMD’s lineup then AMD will be in a position to fruther lower the pricing of its forst generation Epyc/Naples SKUs and have them compete more fiercely with Intel’s lower tiered Xeon Offerings! So that AMD and Intel inter-generational server SKU market competition will begin once Epyc/Rome assumes the Flagship position for AMD and that just makes matters worse for Intel in the lower tiered server market come the latter half of 2019 when AMD will be pricing first generation Epyc SKUs even more agressively.

Are you sure Rome will be a

Are you sure Rome will be a feasible SKU?? or it will be a cpu of nice for some rare applications.

TSMC 7nm “early” is suboptimal and only 7nm “performance” will give some real gains but this will happen only in 2020.

Moreover there is any sign of desktop cpus on early 7nm, this is pretty obvious because there are voices that the clock speed is not high enough to beat GF 12nm.

So my prediction Intel will stay in a confortable 2019 and as soon as TSMC will ship 7nm “performance” it will have a 10nm fully functional. We’ll see in 2020 for both AMD and Intel.

The discussion is not about

The discussion is not about 7nm vurses 10nm it’s about first generation Epyc forcing Intel to lower its server SKUs markups/pricing and rhus taking a hit in the quarterly gross margin figures. And that’s already starting to become apparent to Wallstreet in those Market Quants long term figures that also take into their models Intel’s past margin history in the face of, at that time, AMD’s Opteron sales and that 23% server market share that AMD had with Opteron. Intel’s gross margins fell well below that 60%+ gross margin figure with Intel having around 51% gross margins by Dec 2006 the year that AMD’s Opteron sales and market share was at its highest.

So looking at Those Opteron market share figures and Knowing that Epyc is far closer to Xeon than Opteron could ever hope to be is what has got the Wallstreet folks moving their Intel gross margin guidence lower. First generation Epyc and that Platform advantage of 8 memory channels per socket and 128 PCIe lanes for both the Epyc/SP3 MBs with 1(1P) or 2(2P) sockets so that Epyc/SP3 MB/ecosystem puts first generation Epyc at an advantage even before Epyc/Rome is scheduled to arrive. Epyc’s pricing is also lower than Xeon for those Epyc 32 core SKUs and first generation Epyc is not far off in performance from Xeon on some workloads and leads Xeon on many others.

The cost of Epyc alone will force Intel to have to lower its markups in order to compete with Epyc on the price/performance metrics and Intel currently cannot compete on the 8 memory Channels and 128 PCIe 3.0 lanes that all the Epyc platforms come with Standard as AMD has not segemented Epyc by memory channels or total PCIe lanes.

Rome will be fesable as AMD are no fools when it comes to designing for the future but Rome will undergo the same sorts of certification/vetting that all server SKUs from any maker are subjcted to by the customers’ hired engineers and engineer consultants, software and hardware.

Rome with more cores is very feasible due to that Scalable Data Fabric and the Infinity Fabric. Server wrtkloads are not gaming workloads and most Servers are NUMA aware as are the software systems. Look at all the server OEMs that have come onboard with Epyc and that is a great indicator that Intel will be forced to lower its prices and take a gross margin hit in the face of the stiffest competition that it has ever had.

And I’m not even including the Power9 competition or that ARM ThunderX2 competition that will force both AMD and Intel into the lower markup range for low power servers. AMD is much better able to compete on the lower cost end than Intel who can not afford to lower those margins what with all of Intel’s massive fixed costs in having to maintain fabs and costly middle management pay/perks packages etc.

Intel will have to try with lower prices to match Epyc in the price/performance metric and even the TCO(Total cost of ownership) metrics, Intel can not currently match the features like 128 PCIe 3.0 lanes or 8 memory channels per socket that Epyc/Platform offers. And currently the Meltdown fixes are costing many server customers millions in lost performance because the Meltdown mitigations mean the it will take more servers kept online to make up for the lost performance from those mitigations. The one Spectre mitigation has almost no affect on Epyc’s performance is not going to hurt AMD as much! So that’s making things look even better for more Epyc adoption and a faster adoption rate also for AMD’s Epyc based server products based OEMs.

“I’m not entirely sure how

“I’m not entirely sure how analyzing pretty black and white numbers for 2018 so far has made me biased towards Intel.”

‘Reality has a distinct Intel bias’.

they consumer sales have been

they consumer sales have been slow. the server, workstations are where they are making the money. AMD is slowly pecking away at the workstations. apple also has a lot to do with their workstations. since they charge consumers well well over the price of the chip and the cost of the aluminum they use. HOWEVER their employees are NOT as happy as they seem. they took a huge loss on the X series that was put out to outperform the ryzens.